| |

|

|

| |

|

Presented By Karman Space & Defense

|

| |

|

Axios Pro Rata

|

|

By

Dan Primack

·

Mar 14, 2025

|

| |

| |

|

Top of the Morning

|

| |

|

|

|

Photo illustration: Brendan Lynch/Axios. Photos: Planet Observer/Universal Images Group via Getty Images and Bonnie Cash and Al Drago/Bloomberg via Getty Images

|

| |

|

BlackRock's landmark deal for two Panamanian ports is in danger of running aground, threatened by geopolitical forces outside of its control. Driving the news: Panama's Maritime Authority requested all legal and financial documents involved in the sale, while China urged Hong Kong-based seller CK Hutchinson to "think twice" about a plan that it called a "betrayal." - Meanwhile, NBC News reports that President Trump has "directed the U.S. military to draw up options to increase the American troop presence in Panama ... [including] the less likely option of U.S. troops' seizing the Panama Canal by force."

Zoom in: BlackRock's $22.8 billion agreement with CK Hutchinson, announced on March 4, is broken up into two parts. - The first covers two ports, one on either side of the Panama canal, and only was signed in principle. There's an April 2 deadline for definitive paperwork.

- The second covers another 43 ports in 23 countries, and would seem to be able to proceed even if the Panama piece does not.

Behind the scenes: Panama is in a pickle. - On the one hand, it's hard to see how it could allow a U.S. entity to take control of the ports when a U.S. invasion in being considered. The domestic politics are just too fraught.

- On the other, Panama also might be worried that blocking the deal could give Trump pretext to invade — claiming that it's confirmation of Chinese control over the canal.

The big picture: BlackRock, which declined comment, is looking more and more like a supporting player in its own blockbuster. - BlackRock CEO Larry Fink would laugh at the idea of being considered a Trojan Horse for Trump, who couldn't even bring himself to utter the firm's name during last week's address to Congress.

- But that doesn't lessen the fears in Panama. Nor the pressure that Beijing is beginning to put on CK Hutchinson, which plans to retain its Hong Kong and Mainland China ports.

The bottom line: Panama, we have a problem.

|

|

| |

| |

|

The BFD

|

| |

|

|

|

Illustration: Sarah Grillo/Axios

|

| |

|

Compass (London: CPG) is in advanced talks to acquire rival real estate brokerage HomeServices of America from a unit of Warren Buffett's Berkshire Hathaway, per the WSJ. Why it's the BFD: Buffett doesn't usually sell operating assets. - This also comes just days after Redfin agreed to be acquired for $1.75 billion by Dan Gilbert's Rocket Companies.

The bottom line: A merger would combine America's first and fourth-largest home brokerages by sales, with a combined $319 billion in 2024 sales.

|

|

| |

| |

|

Venture Capital Deals

|

| |

|

• Flock Safety, an Atlanta-based provider of surveillance tech for public safety departments, raised $275m at a $7.5b valuation. A16z led, and was joined by GreenOaks Capital, Bedrock Capital, Meritech Capital, Matrix Partners, Sands Capital, Founders Fund, Kleiner Perkins, Tiger Global, and YC. axios.link/4kOtjDi • Plata, a Mexican consumer credit startup, raised $160m in Series A funding at a $1.5b valuation. Kora led, and was joined by Moore Strategic Ventures. axios.link/4iMZCk7 ⚡ Terabase Energy, a Berkeley, Calif.-based provider of utility-scale solar software, raised $130m in Series C funding led by SoftBank. axios.link/4hu0pW9 • Omni, a business intelligence platform, raised $69m in Series B funding. Iconiq Growth led, and was joined by Theory Ventures, First Round Capital, Redpoint Ventures, GV, and Snowflake Ventures. axios.link/43IUN76 • Alloyed, a U.K. maker of metallic components for aerospace and electronics, raised £37m in Series B funding. Sparx and the Development Bank of Japan co-led, and were joined by Aviva Investors and Future Industry Ventures. axios.link/3DKi0LN • Curve, a London-based digital wallet, raised £37m. Hanaco Ventures, led, and was joined by insiders Fuel Ventures, IDC, Outward VC and Stanley Fink. curve.com • Town, a tax platform for small businesses, raised $18m in seed funding. First Round Capital led, and was joined by Conviction, Alt Capital, Mischief, and WndrCo. town.com • Human Computer, a Windsor, Calif., game studio, raised $5.7m in seed funding led by Makers Fund. human.computer • OptimHire, an SF-based AI recruiting startup, raised $5m led by Mucker Capital. optimhire.com

|

|

| |

| |

|

A message from Karman Space & Defense

|

|

Karman’s NYSE debut fuels innovation

|

| |

|

| |

|

Karman Space & Defense is now publicly traded on the New York Stock Exchange (NYSE), fueling its next phase of growth.

The impact: The successful IPO will help the company expand opportunities and increase technologies and capabilities.

Learn more.

|

| |

| |

|

Private Equity Deals

|

| |

|

• Binance secured a $2 billion investment from Emirati state-owned investment firm MGX. axios.link/41PQrZm • Blackstone agreed to buy a 40% stake in listed Indian real estate developer Kolte-Patil Developers for $134m. axios.link/4hxPZ7S • Celnor Group, a British portfolio company of Inflexion, acquired John Turner Consulting, a New Hampshire consultancy for the construction, infrastructure, and built environment sectors. celnor.com 🚑 Eir Partners invested in Porter, a Baltimore-based home care coordination platform. helloporter.com • Euna Solutions, a Chicago-based stakeholder engagement firm owned by GI Partners and Golub Capital, acquired grant management platform AmpliFund from Blu Venture Investors and Next Sparc Growth Partners. axios.link/3DFahP0 ⚡ Enverus, an Austin, Texas-based energy software firm owned by Hellman & Friedman, bought Pearl Street, a provider of grid interconnection software that had raised funding from Powerhouse Ventures, VoLo Earth Ventures, Pear, and Matt Rogers' Incite. enverus.com • Keensight Capital agreed to acquire a majority stake in Actico Group, a German provider of regulatory compliance and risk management solutions. actico.com • Northleaf Capital Partners invested C$100m into Shared Tower, a Canadian developer and owner of carrier-neutral telecom infrastructure. Sellers include 3i Group. axios.link/4bTnf8t • PSG invested in Lightkeeper, a Boston-based provider of data, analytics, risk management, and reporting solutions for investment managers. lightkeeper.com • PSP Investments agreed to buy a 7.51% stake in Canadian toll road operator 407 ETR from CPP Group. In a separate but related deal, CPP would acquire a 1.7% stake in 407 ETR from AtkinsRéalis Group (TSE: ATRL), which would sell another 5.06% position to Ferrovial. axios.link/3FwhGRq • Total Access, a Santa Fe Springs, Calif., elevator services firm owned by Century Park Capital Partners, acquired Simi Valley, Calif.-based Vertical Elevator Solutions. totalaccesselevator.com • Zayo, a communications infrastructure company owned by DigitalBridge and EQT, agreed to acquire the fiber solutions unit of Crown Castle (NYSE: CCI) for $4.25b. axios.link/4iOt09J

|

|

| |

| |

|

Liquidity Events

|

| |

|

🏋️ Berkshire Partners is seeking to sell fitness brand CrossFit, per the NY Times. axios.link/3XRZJCV

|

|

| |

| |

|

More M&A

|

| |

|

• AvidXchange (Nasdaq: AVDX), a Charlotte-based accounts payable automation company, hired FT Partners to explore a sale after receiving inbound interest, per Bloomberg. axios.link/3FFA8qA • Kaspi.kz JSC, a Czech-listed firm owned by billionaire Vyacheslav Kim, is in talks to buy Rabobank's Turkey unit, per Bloomberg. axios.link/3XQE1zb 🎵 Pershing Square, the hedge fund led by Bill Ackman, expects to raise around $1.4b via the sale of a 2.7% stake in Universal Music Group. axios.link/4kPUQ7f • Reggeborgh, a Dutch investment firm, acquired a 3% stake in ABN Amro. axios.link/4hzUzm2 • Toyota Tsusho (Tokyo: 8015) agreed to acquire recycled metal products maker Radius Recycling (Nasdaq: RDUS) for $1.34b in cash, or $30 per share (120% premium to yesterday's close). axios.link/3XVqMxh

|

|

| |

| |

|

Fundraising

|

| |

|

• bd-capital, a London-based midmarket PE firm, raised €430m for its second fund. bd-cap.com • Daybreak Ventures, a VC firm led by Rex Woodbury, raised $33m for its debut fund. axios.link/3DEKczG • Monarch Collective, an investment firm focused on women's sports, expected its debut fund to $250m from $150m. axios.link/43KpQPV

|

|

| |

| |

|

It's Personnel

|

| |

|

• Timothy Barakett, founder and CEO of TRB Advisors, joined KKR's board as an independent director. axios.link/3FvmciW • John Beczak joined Petra Funds Group as CFO, after serving in a similar role with Resource Capital Funds. axios.link/4bOvUsJ • Alexander Fraser joined OMERS as head of private equity. He previously was with Temasek-owned 65 Equity Partners. axios.link/41HM56s

|

|

| |

| |

|

Final Numbers

|

| |

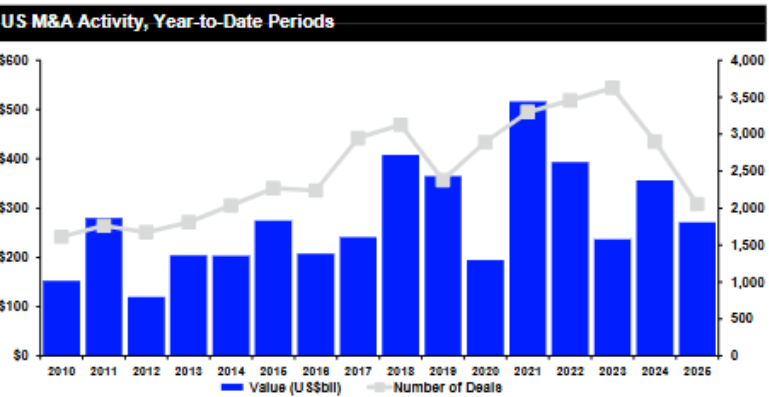

Source: LSEG Deals Intelligence. Data though March 13, 2025. Goldman Sachs CEO David Solomon today wrote in a shareholder letter that some of its corporate clients are "acting more cautiously until they have more clarity" on President Trump's economic policies. - This follows what he called a "meaningful shift in CEO sentiment" following Trump's election, driven by expected deregulation that increased the appetite for dealmaking and capital markets activity.

|

|

| |

| |

|

A message from Karman Space & Defense

|

|

Karman makes NYSE debut

|

| |

|

| |

|

Karman Space & Defense, a solutions provider specializing in mission-critical systems for missile defense and space programs, recently went public on the New York Stock Exchange (NYSE).

- “We are just getting started,” said CEO Tony Koblinski.

Learn more.

|

| |

|

✔️ Thanks for reading Axios Pro Rata, and to copy editor Bryan McBournie! Please ask your friends, colleagues, and realtors to sign up.

|

|

|

Dive deeper into VC, PE and M&A

|

|

|

|

.webp)